vermont income tax refund

866 828-2865 toll-free in Vermont Email. To track the status of your Vermont income tax refund for 2021 you will need the following information.

Filing A Vermont Income Tax Return Things To Know Credit Karma

Vermont Insurance Premium Tax Return.

. 877 290-1400 FAX. However be aware that not paying Vermont income tax by the due date means youll face interest and penalties and other consequences like tax liens debt collection or even garnishment of your wages. Find IRS or Federal Tax Return deadline details.

E-Filing non-resident VT state returns is not available. Extensions - A 6-month extension is available to extend the filing of a Vermont income tax return by filing Form IN-151 - Application for Extension of Time to File Form IN-111. Sales Use Tax Form SUT-451.

Nor did ESD use the Vermont income tax refund offset program which allows any State agency to send their. And you are filing a Form. To check the status of your Vermont state refund online follow these steps.

Vermont income taxes are imposed on individuals and entities taxpayers that vary with the profitable income taxable income of the taxpayer. Find out when your Vermont Income Tax Refund will arrive. Its top rate however is.

E-File is not available for Vermont. The Vermont Department of Taxes issues the refund check to the name or names on the return. The Vermont tax filing and tax payment deadline is April 18 2022.

If you have further. If you received Form 1099-G for unemployment compensation from the Vermont Department of Labor and have questions please review information on the Department of Labors website. Vermont State Tax Filing Deadline Vermont income tax returns are due on April 15th.

You can also track your refund with. Vermont Department of Taxes. Checks can be cashed up to 180 days after the issue date.

132 STATE STREET MONTPELIER VERMONT 05633-5101 802 828-2281 TOLL-FREE IN VT. Department of the Treasury Internal Revenue Service Kansas City. If mailing your return with a payment mail to.

Vermonters Urged to Claim Tax Credit to Lower Taxes or Receive Refund. Click on Check the Status of Your Return Personal Income Tax Return Status. Department of Taxes Check Return or Refund Status No.

If your state tax witholdings are greater then the amount of income tax you owe the state of Vermont you will receive an income tax refund check from the government to make up the difference. Understand and comply with their state tax obligations. You will be prompted to enter.

Use myVTax the departments online portal to check on the filing or refund of your Vermont Income Tax Return Homestead Declaration and Property Tax Adjustment Claim Renter Rebate Claim and Estimated Payments. You can track your Vermont state tax refund using myVTax the Vermont Department of Taxes online system. IN-111 Vermont Income Tax Return.

Vermont State Tax Refund Status Information. Like many other states Vermonts state income tax is progressive. It should take one to three weeks for your refund check to be processed after your income tax return is recieved.

Submit Your Return or Payment by Mail. Tracking your Vermont tax refund. Allow sufficient time before you attempt to track the status of your state income tax return.

Vermont State Income Tax Return forms for Tax Year 2021 Jan. Alternatively you can make a payment by check or money order mailed to the. 31 2021 can be e-Filed along with an IRS Income Tax Return by the April 18 2022 due date.

Please wait at least three days before checking the status of your return on electronically filed returns and six to eight weeks for paper-filed returns. You can pay your Vermont tax bill online using a credit card or ACH debit. Filing an Amended Vermont State Tax Return To make a correction to the Vermont tax return you filed use Form IN-111 for the year you are amending.

Tax Credits Earned Applied Expired and Carried Forward if applicable. 802 828-2198 AUDITORVERMONTGOV WWWAUDITORVERMONTGOV DOUGLAS R. Vermont Department of Taxes.

ID type SSNITIN ID number. Taxvermontgov You can help us speed up the processing of your return and refund by following these tips. Our mission is to serve Vermonters by administering our tax laws fairly and efficiently to help taxpayers.

If mailing your return requesting a refund no balance due or no payment mail to. Sales and Use Tax Return. Check For the Latest Updates and Resources Throughout The Tax Season.

This form is only used for the income tax return and does not extend the filing of any Homestead Declaration or Property Tax Adjustment Claim. Last tax season more than 45000 Vermonters claimed the federal and state Earned Income Tax Credit. And you ARE NOT ENCLOSING A PAYMENT then use this address.

Non-resident VT state returns are available upon request. Commissioner Craig Bolio Deputy Commissioner Rebecca Sameroff 802 828-2505 Department Directory. Separate taxes such as Income and Property Tax are assessed against each taxpayer meeting certain minimum criteria.

Preparation of a state tax return for Vermont is available for 2995. Direct Deposit is not available for Vermont. Ad Learn How to Track Your Federal Tax Refund and Find the Status of Your Direct Deposit.

MONTPELIER VtThousands of working Vermonters are potentially missing out on a federal and state income tax credit that if claimed could result in a lower tax bill and a sizeable refund check. File My Federal Vermont State Returns. If you live in VERMONT.

Vermont Department of Taxes states that you should receive your VT tax refund in 6 to 8 weeks if you e-file and 8 to 10 weeks if filing on paper. The refund date youll see doesnt include the days your financial institution may take to process a direct deposit or the time a paper check may take to arrive in the mail. How Do I Pay My Vermont State Income Taxes.

If your state tax witholdings are greater then the amount of income tax you owe the state of Vermont you will receive an income tax refund check from the government to make up the difference. If you used direct deposit check with your bank for deposit information. If you file a tax extension you can e-File your Taxes until October 15 2022.

If we cannot process your form we consider your tax return not filed which may result in late fees and penalties. Use a tax professional or volunteer assistance to prepare and file your return. And you ARE ENCLOSING A PAYMENT then use this address.

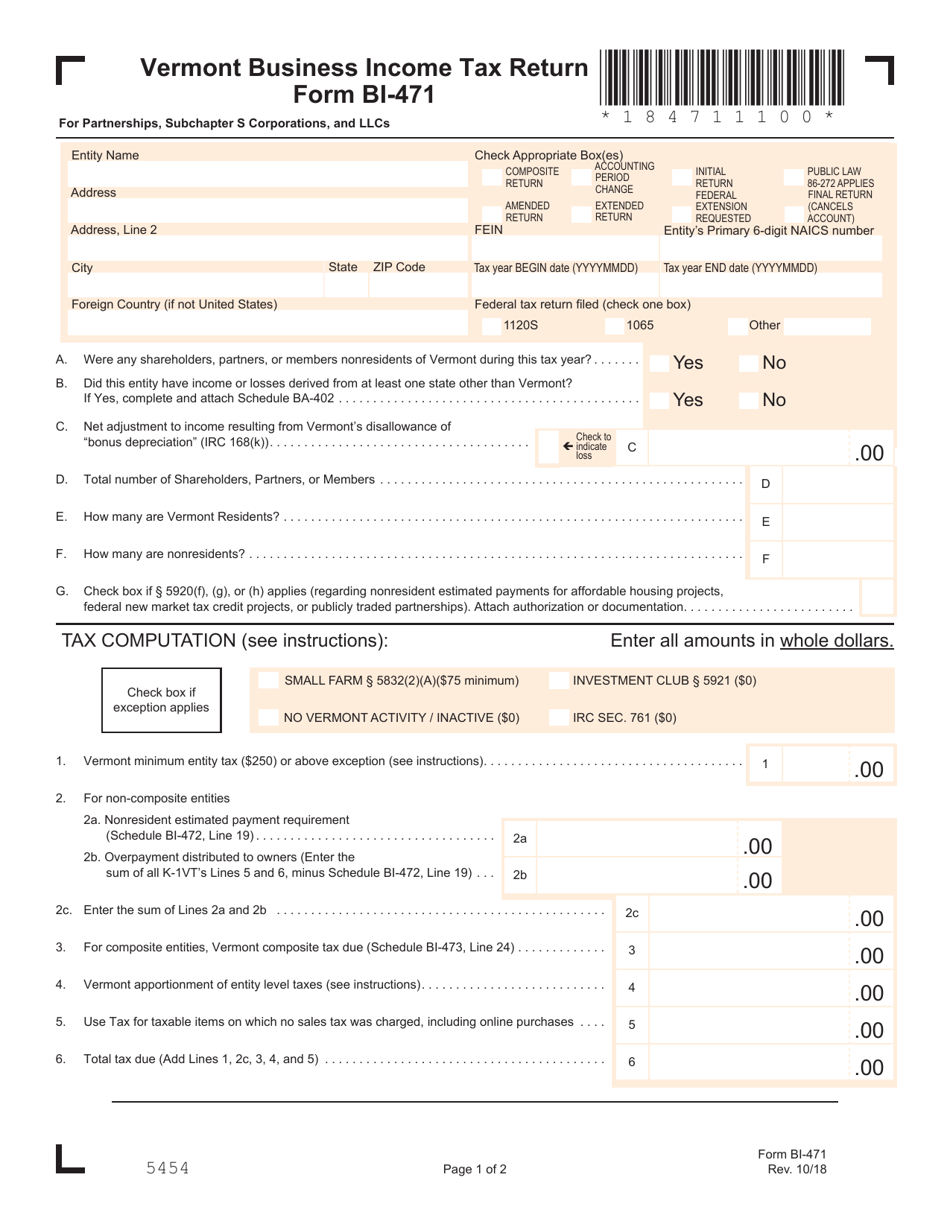

If you still have questions about your state tax refund contact the Vermont Department of Taxes Individual Income Tax Division. Business Income Tax Return for Vermont Residents Only For qualifying businesses owned exclusively by Vermont residents.

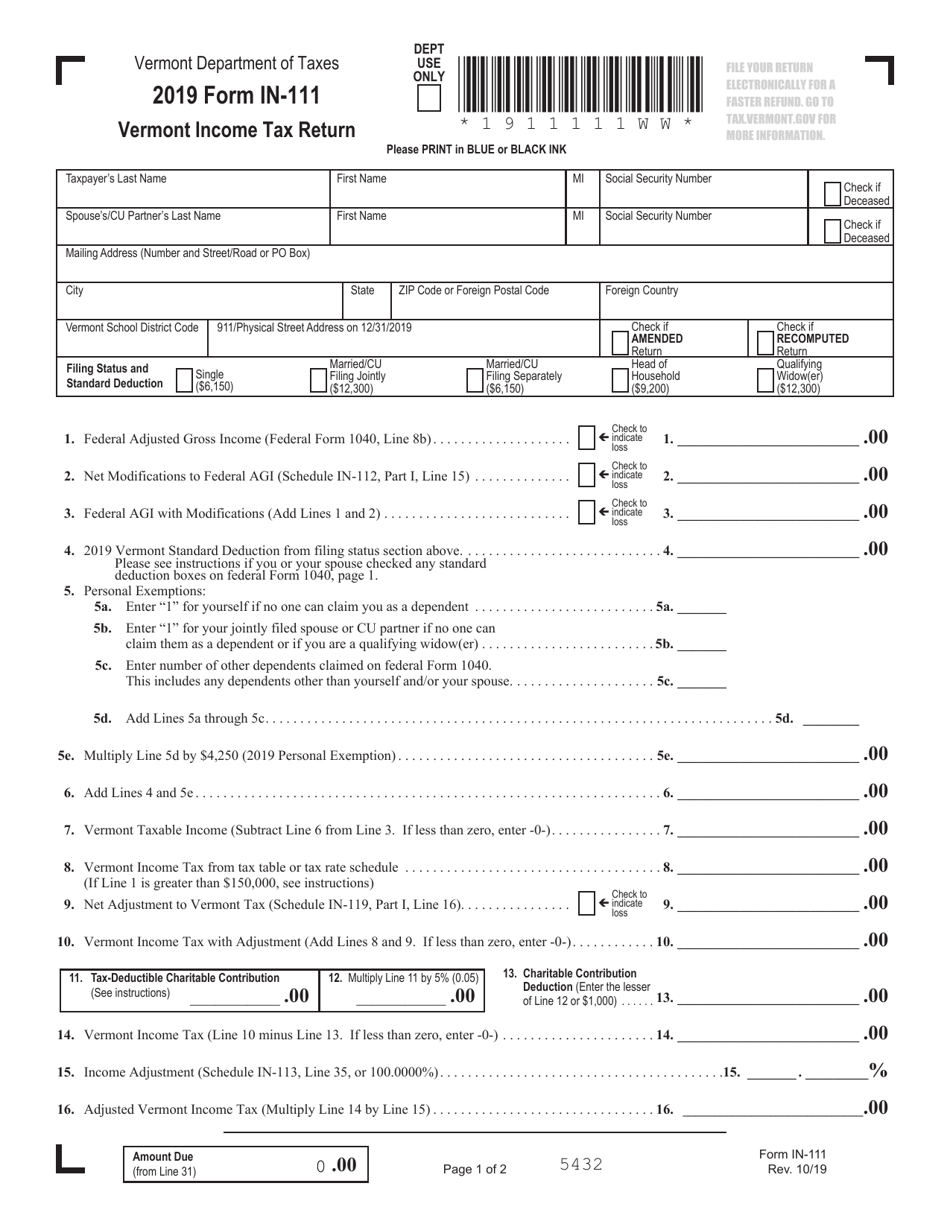

Form In 111 Download Fillable Pdf Or Fill Online Vermont Income Tax Return 2019 Vermont Templateroller

Form In 111 Vermont Income Tax Return

Form In 111 Vermont Income Tax Return

Where S My Vermont State Tax Refund Taxact Blog

Vermont Tax Forms And Instructions For 2021 Form In 111

Vt Form Bi 471 Download Printable Pdf Or Fill Online Business Income Tax Return Vermont Templateroller

Vermont Department Of Taxes Issuing 1099 Gs For Economic Recovery Grants And Taxable Refunds Department Of Taxes

Vermont Income Tax Vt State Tax Calculator Community Tax

Vermont Tax Form In 111 Fill Online Printable Fillable Blank Pdffiller

Personal Income Tax Department Of Taxes

Filing Season Updates Department Of Taxes

Where S My Refund Vermont H R Block

Vermont Department Of Taxes Facebook

Vt Dept Of Taxes Vtdepttaxes Twitter

Personal Income Decline Drives Down General Fund Tax Revenues Vermont Business Magazine

Vermont Department Of Taxes Issuing 1099 Gs For Economic Recovery Grants And Taxable Refunds Department Of Taxes

1098 T Tax Information W 9s Form Bursar S Office Virginia Tech